MCEX and DROs

Membership

Guided by regulatory requirement in Macau, we are currently open to Regulated Financial Institutions to become MCEX members.

The institution will qualify as a Regulated Financial Institution if the institution is regulated and meets the criteria below:

a) a regulated financial institution that carries on the business of the provision of investment services in Macao or other jurisdictions;

b) a regulated banking institution in Macao or other jurisdictions;

c) a regulated insurance company in Macao or other jurisdictions;

d) a regulated pension fund management company in Macao or other jurisdictions;

e) a regulated collective investment scheme in Macao or other jurisdictions;

As part of our obligations to the Monetary Authority of Macao, we are required to conduct KYC and AML checks to prevent money laundering and other abuses from occurring on the MCEX platform.

Please note all KYC documents listed under the class of members are required and must either be originals or certified true copies:

CERTIFICATION OF DOCUMENTS

- Documents must be in one of the following formats – .pdf, .png, .jpg, .jpeg

- Should be visible in full, with all four corners captured (in case it is a photo/scan)

- All the KYC documents should be clearly visible & in certified true copies

- Certification requirement: Documents that require certification should be certified by the

professional below:

o Certified public accountant

o Lawyer

o Chartered secretary (i.e., current member of The Chartered Governance Institute)

o A member of the judiciary

o Board of Directors/Managers of the Regulated Financial Institutions (Only applicable for Regulated Financial Institutions)

o Notary Public

In addition, the following should be observed:

o The certifier to clearly state his/her name and capacity

o The certifier to state that the document is a True Copy of the original (or words to similar effect)

o The certification to be completed within 3 months from the submission date

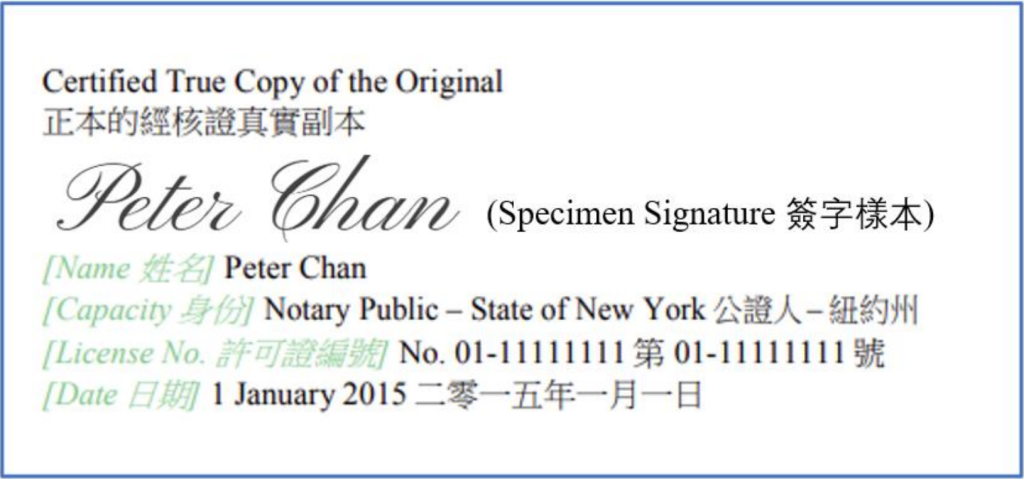

SAMPLE of certification documents:

All applications will be subjected to our Know Your Customer (KYC), Anti-money Laundering (AML) processes and any local regulatory requirements in respective jurisdictions

The minimum age to sign up for an account would be 18 years old and above.

Membership Application

Follow these steps to set up an account:

I. Click the “Become a member” icon and sign up by selecting appropriate “Professional Investor” type.

II. Fill up the relevant account opening information and upload the required documents.

III. Upon submission of your application, our team will conduct a KYC (Know Your Customer) and AML

(Anti-Money Laundering) check. You (The registered email) will be notified on the results of your application via email. For successful applications, you’ll be able to sign in right away upon receiving the email with an OTP.

The verification code will be sent to your email address. If you do not receive your verification code for the first time, you may request a new verification code by clicking on the “获取验证码” button. If you are still encountering issues, please reach out to us at memberservices@mcex.mo.

Areas with a symbol, “ * “ of the form are MUST filled.

Post-Application

1) Click “Log In” on the landing page.

2) Insert your login name and OTP password.

3) You’ll have to change your password on first time login

You may email to MCEX team memberservices@mcex.mo to check your account status.

You can write to us at memberservices@mcex.mo and provide information regarding any changes in circumstances that may cause any of your information to be incomplete or inaccurate.

For General Enquiry, please contact us at:

• Email Address: info@mcex.mo

• Phone Number/Toll Free Number (Office hours: Monday to Friday – 9:30am to 6:00pm):

o Hong Kong: +852 26680268

o Macao: 0800736

o China: 4008424302

o Japan: 00531-85-0200

o Singapore: 800-8528-659

o Taiwan: 801857177

o UK: 8082341170

o USA: 1-833-552-0552

o Saudi Arabia: 8008851262